I agree to and consent to receive news, updates, and other communications by way of commercial electronic messages (including email) from Entrée Resources. I understand I may withdraw consent at any time by clicking the unsubscribe link contained in all emails from Entrée Resources.

Overview

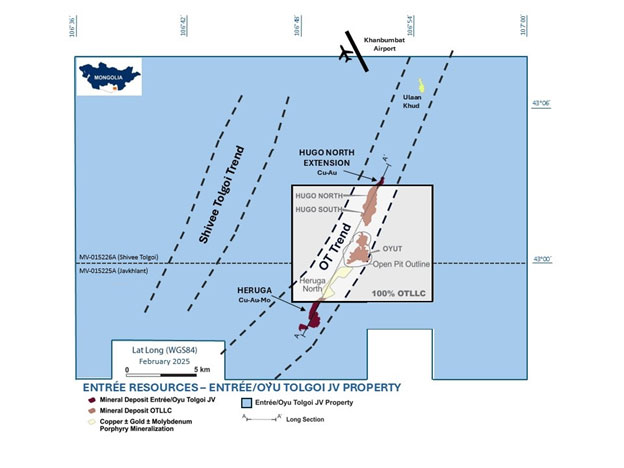

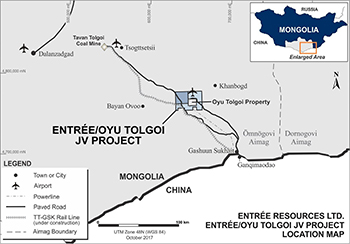

The Oyu Tolgoi project is one of the world’s largest new copper-gold mines and is located in the South Gobi region of Mongolia. The Oyu Tolgoi project comprises two separate land holdings: the Entrée/Oyu Tolgoi JV Property, which is a partnership between Entrée and OTLLC, and the Oyu Tolgoi mining licence, which is held by OTLLC.

Entrée has a 20% participating interest in mineralization on the Entrée/Oyu Tolgoi JV Property extracted below 560 metres elevation, which includes all of the Hugo North Extension and Heruga deposits, and a 30% participating interest in mineralization identified above 560 metres elevation.

The Entrée/Oyu Tolgoi JV Property comprises the geographical area covered by the Shivee Tolgoi and Javkhlant mining licences. The Entrée/Oyu Tolgoi JV Property covers 62,920 hectares and hosts:

- Hugo North Extension Copper-Gold Porphyry Deposit, Lifts 1 and 2

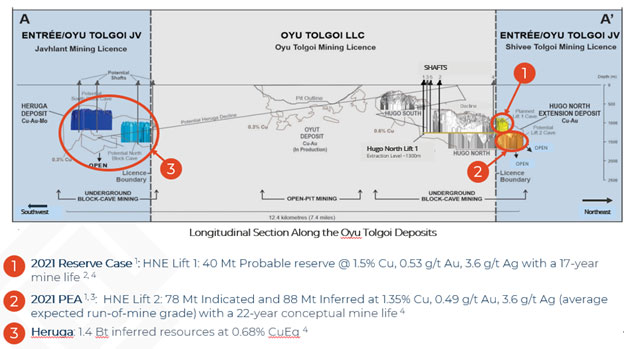

- Lift 1 is the upper portion of the Hugo North Extension copper-gold porphyry deposit and forms the basis of the 2021 Reserve Case. It is the northern portion of the Lift 1 Panel 1 underground block cave. Hugo North Extension Lift 1 Probable reserves include 40 million tonnes ("Mt") grading 1.54% copper, 0.53 grams per tonne ("g/t") gold, and 3.63 g/t silver.

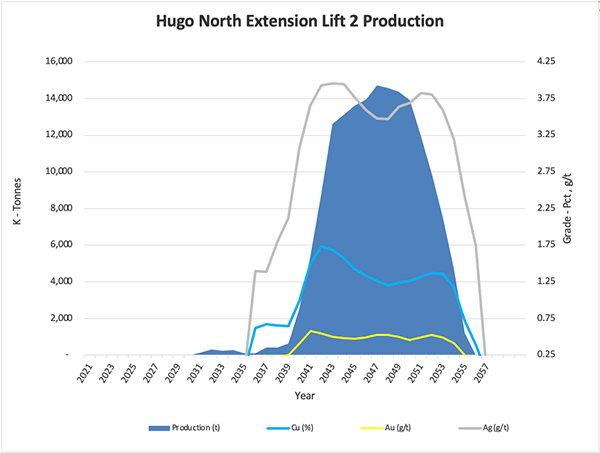

- Lift 2 is directly below and extends north beyond Lift 1 and is the next potential phase of underground mining on the Entrée/Oyu Tolgoi JV Property, once Lift 1 mining is complete. Mineral resources from Lift 2 form the basis of the 2021 PEA mine plan, which include: 78 Mt (Indicated) and 88 Mt (Inferred). The average expected run-of-mine feed grade of 1.35% copper, 0.49 g/t gold, and 3.6 g/t silver includes dilution and mine losses.

- Heruga Copper-Gold-Molybdenum Porphyry Deposit

- Heruga is the southernmost deposit at Oyu Tolgoi, ~93% of which occurs on the Entrée/Oyu Tolgoi JV Property. Inferred mineral resources include: 1,400 Mt grading 0.41% copper, 0.40 g/t gold, 1.5 g/t silver and 120 parts per million ("ppm") molybdenum. While Heruga is not included in the 2021 PEA, it provides opportunity for future exploration and potential development.

- A large prospective land package with numerous priority exploration targets.

The 12.4-kilometre trend of porphyry deposits that comprise the Oyu Tolgoi project is shown below in a north-northeast oriented, west-looking longitudinal section (A-A’).

The Oyu Tolgoi mining licence is held by OTLLC (owned 66% by Rio Tinto and 34% by the Government of Mongolia). Rio Tinto is the operator of the existing open pit mine on the Oyu Tolgoi mining licence and is currently managing the ramp-up of the Hugo North (including Hugo North Extension) Lift 1 underground mine on both the Oyu Tolgoi mining licence and the Entrée/Oyu Tolgoi JV Property.

Under the terms of the Entrée/Oyu Tolgoi JVA, Entrée has a 20% participating interest in mineralization extracted below 560 metres elevation, which includes all of the Hugo North Extension and Heruga deposits, and a 30% participating interest in mineralization identified above 560 metres elevation. OTLLC has the remaining 80% (or 70%) participating interest.

On June 6, 2025, the Company announced the Entrée/Oyu Tolgoi JV had paused development work on Hugo North Extension Lift 1 pending transfer of title to the Entrée/Oyu Tolgoi JV mining licences from Entrée LLC to OTLLC on behalf of the Entrée/Oyu Tolgoi JV participants. If Lift 1 Panel 1 lateral development work is significantly delayed, it could have an adverse effect (which could be material) on development costs and schedule, the business, assets, future cash flow, and financial condition of the Company, and the Company’s share price. See the Company’s news release dated June 6, 2025 titled, "Entrée Resources Announces Pause in Oyu Tolgoi Lift 1 Panel 1 Underground Development Work".

Robert Cinits, P.Geo., approved the scientific and technical information about the Entrée/Oyu Tolgoi JV Property on this website. Portions of the information are based on assumptions, qualifications and procedures which are not fully described herein. Reference should be made to the Company’s most recently filed Management’s Discussion & Analysis and Annual Information Form, which are available on this website or on SEDAR+ (www.sedarplus.ca). The results of the 2021 Reserve Case and 2021 PEA can be found in the Technical Report that is filed on SEDAR+ and HERE.

The 2021 Reserve Case is discussed in a Technical Report titled, "Entrée/Oyu Tolgoi Joint Venture Project, Mongolia, NI 43-101 Technical Report" with an original effective date of May 17, 2021 and an amended effective date of October 8, 2021. The 2021 Reserve Case is based on mineral reserves attributable to the Entrée/Oyu Tolgoi JV from Hugo North Extension Lift 1.

The Technical Report also includes the 2021 PEA on a conceptual Hugo North Extension Lift 2. The 2021 PEA is based on Indicated and Inferred mineral resources from Lift 2, as the second potential phase of development and mining on the Hugo North Extension deposit. Lift 2 is directly below and extends north beyond Lift 1. There is no overlap in the mineral reserves from the 2021 Reserve Case and the mineral resources from the 2021 PEA. Development and capital decisions will be required for the eventual development of Lift 2 once production commences at Hugo North Extension Lift 1.

LOM highlights of the production and financial results from the 2021 Reserve Case and the 2021 PEA are summarized below.

| Entrée/Oyu Tolgoi JV Property | Units | 2021 Reserve Case | 2021 PEA |

| Attributable Financial Results | |||

| Cash Flow, pre-tax | US$M | 449 | 1,982 |

| NPV(5%), after-tax | US$M | 185 | 541 |

| NPV(8%), after-tax | US$M | 131 | 306 |

| NPV(10%), after-tax | US$M | 104 | 213 |

| LOM Recovered Metal | |||

| Copper Recovered | Mlb | 1,249 | 4,564 |

| Gold Recovered | koz | 549 | 2,025 |

| Silver Recovered | koz | 3,836 | 15,067 |

| LOM Processed Material | |||

| Probable Reserve Feed | 40 Mt @ 1.54% Cu, 0.53 g/t Au, 3.63 g/t Ag | ---- | |

| Indicated Resource Feed | ---- | 77.9 Mt @ 1.35% Cu, 0.49 g/t Au, 3.6 g/t Ag (1.64% CuEq) | |

| Inferred Resource Feed | ---- | 87.8 Mt @ 1.35% Cu, 0.49 g/t Au, 3.6 g/t Ag (1.64% CuEq) |

Notes:

- Long term metal prices used in the net present value (NPV) economic analyses for the 2021 Reserve Case and the 2021 PEA are: Cu US$3.25/lb, Au US$1,591.00/oz, Ag US$21.08/oz.

- Mineral reserves in the 2021 Reserve Case, and mineral resources in the 2021 PEA mine plan are reported on a 100% basis.

- Entrée has a 20% interest in the above processed material and recovered metal.

- The mineral reserves that form the basis of the 2021 Reserve Case are from a separate portion of the Hugo North Extension deposit than the mineral resources in the 2021 PEA.

- Copper equivalent (CuEq) is calculated as shown in the mineral reserves and mineral resources statements on this website.

- 2021 Reserve Case cash flows are discounted to the beginning of 2021.

- 2021 PEA cash flows are discounted to the beginning of 2027, the assumed beginning of Hugo North Lift 2 development. Attributable Entrée/Oyu Tolgoi JV production is assumed to begin in 2031 and ramp-up to stable production in 2043. Final Entrée/Oyu Tolgoi JV attributable production is assumed to conclude in 2056.

- Indicated and Inferred resource average expected run-of-mine feed grade of 1.35% Cu, 0.49 g/t Au, and 3.6 g/t Ag (1.64% CuEq) includes dilution and mine losses.

The economic analysis in the 2021 PEA is based on a conceptual mine plan and does not have as high a level of certainty as the 2021 Reserve Case. The 2021 PEA is preliminary in nature and includes Inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the 2021 PEA will be realized. Mineral resources are not mineral reserves and do not have demonstrated economic viability.

In both the 2021 Reserve Case and the 2021 PEA, Entrée is only reporting the production and cash flows attributable to the Entrée/Oyu Tolgoi JV Property, not production and cash flows for other Oyu Tolgoi project areas owned 100% by Entrée’s joint venture partner, OTLLC. The production and cash flows from the 2021 Reserve Case and the 2021 PEA are from separate parts of the Hugo North Extension deposit and there is no overlap of the mineralization.

Both the 2021 Reserve Case and the 2021 PEA are based on information supplied by OTLLC or reported within OTFS20. The results of the 2021 Reserve Case and 2021 PEA can be found in the Technical Report that is filed on SEDAR+ and HERE.

Neither OTFS20 nor the results of the 2021 Reserve Case and 2021 PEA reflect the impacts of delays due to later than planned commencement of the Panel 0 undercut on the Oyu Tolgoi mining licence, lateral development scope changes, impacts of COVID-19 on development progression and delays to Shafts 3 and 4, which were commissioned during the third quarter 2024 and are required to provide ventilation to support production from Panels 1 and 2 during ramp-up. First development work on Hugo North Extension Lift 1 commenced in October 2024 but was paused in June 2025. The timing of any future development work in the Hugo North Extension deposit footprint is contingent upon the resolution of certain outstanding issues, including the transfer of the Shivee Tolgoi mining licence from the Company’s Mongolian subsidiary Entrée LLC to OTLLC. OTFS23, which includes the technical studies for Panels 1 and 2 mine design and schedule optimization, remains subject to acceptance by applicable regulatory bodies in Mongolia.

Key Financial Outputs

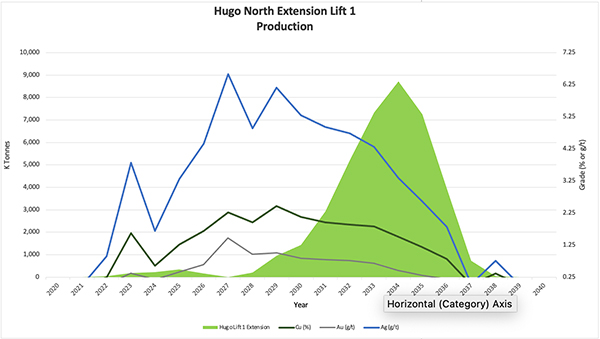

Does not reflect previously reported delays; corresponding years are scheduled to change based on OTFS23 and the timing of resolution of certain outstanding issues, including the transfer of the Shivee Tolgoi mining licence from Entrée LLC to OTLLC.

Key financial assumptions and outputs from the 2021 Reserve Case are as follows (reported on a 100% Entrée/Oyu Tolgoi JV basis unless otherwise noted; assumes long term metal prices of US$3.25 copper, US$1,591.00/oz gold and US$21.08/oz silver):

- Hugo North Extension Lift 1: 17-year Lift 1 mine life ("LOM") production (4-years development production and 13-years block cave production).

- Maximum production rate of approximately 25,000 tonnes per day ("tpd"), which is blended with production from OTLLC’s Oyut open pit deposit and Hugo North deposit to supply a maximum mill throughput rate of 125,000 tpd.

- Total recovered metal over the LOM of Hugo North Extension Lift 1: 1,249,000 lbs copper, 549,000 oz gold, 3,836,000 oz silver.

- Total direct development and sustaining capital expenditures of approximately US$275.7 million (US$55.1 million attributable to Entrée).

- Entrée LOM average cash cost before credits US$1.57/lb payable copper.

- Entrée LOM average cash costs after credits ("C1") US$0.79/lb payable copper.

- Entrée LOM average all-in sustaining costs ("AISC") US$1.26/lb payable copper.

Notes: Entrée has a 20% attributable interest in the above processed material.

Does not reflect previously reported delays; corresponding years are scheduled to change based on OTFS23 and the timing of resolution of certain outstanding issues, including the transfer of the Shivee Tolgoi mining licence from Entrée LLC to OTLLC.

Key financial assumptions and outputs from the 2021 PEA are as follows (reported on a 100% Entrée/Oyu Tolgoi JV basis unless otherwise noted; assumes long term metal prices of US$3.25 copper, US$1,591.00/oz gold and US$21.08/oz silver):

- Hugo North Extension Lift 2: 22-year Lift 2 mine life (4-years development production and 18-years block cave production).

- Maximum production rate of approximately 40,500 tpd, which is blended with production from OTLLC’s Oyut open pit deposit and Hugo North deposit to supply a maximum mill throughput rate of 125,000 tpd.

- Total metal production over the LOM of Hugo North Extension Lift 2: 4,564,000 lbs copper, 2,025,000 oz gold, 15,067,000 oz silver.

- Total direct development and sustaining capital expenditures of approximately US$1,589.6 million (US$319.7 million attributable to Entrée).

- Entrée LOM average cash cost before credits US$1.10/lb payable copper.

- Entrée LOM average C1 US$0.30/lb payable copper.

- Entrée LOM average AISC US$0.92/lb payable copper.

The 2021 Reserve Case and the 2021 PEA are mutually exclusive; if the 2021 Reserve Case is developed and brought into production, the mineralization from Hugo North Extension Lift 2 is not sterilized or reduced in tonnage or grades. In addition, the Heruga deposit, which is not included in either the 2021 Reserve Case or the 2021 PEA, provides a great deal of future potential and with further exploration and development could become a completely standalone underground operation, independent of other Oyu Tolgoi project underground development, and provide considerable flexibility for mine planning and development.

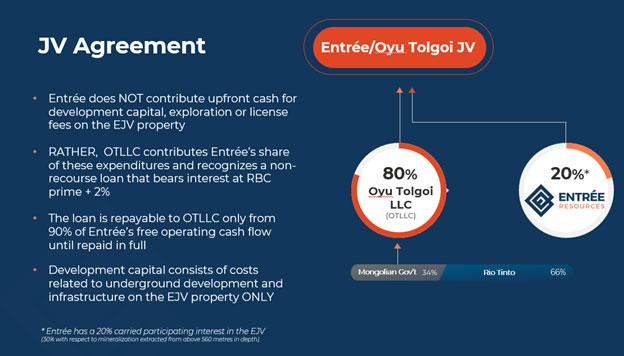

Capital and Operating Costs

Under the terms of the Entrée/Oyu Tolgoi JVA, OTLLC is responsible for 80% of all costs incurred on the Entrée/Oyu Tolgoi JV Property for the benefit of the Entrée/Oyu Tolgoi JV, including capital expenditures, and Entrée is responsible for the remaining 20%. In accordance with the terms of the JVA, Entrée has elected to have OTLLC debt finance Entrée’s share of costs for approved programs and budgets, with interest accruing at OTLLC’s actual cost of capital or prime +2%, whichever is less, at the date of the advance. Debt repayment may be made in whole or in part from (and only from) 90% of monthly available cash flow arising from the sale of Entrée’s share of products. Available cash flow means all net proceeds of sale of Entrée’s share of products in a month less Entrée’s share of costs of Entrée/Oyu Tolgoi JV activities for the month that are operating costs under Canadian generally accepted accounting principles.

The following is a description of how Entrée recognizes its share of Oyu Tolgoi project capital costs, specifically, the timing of recognition under the terms of the JVA and generally accepted accounting principles.

Under the terms of the JVA, any mill, smelter and other processing facilities and related infrastructure will be owned exclusively by OTLLC and not by Entrée. Mill feed from the Entrée/Oyu Tolgoi JV Property will be transported to the concentrator and processed at cost (using industry standards for calculation of cost including an amortization of capital costs). Underground infrastructure on the Oyu Tolgoi mining licence is also owned exclusively by OTLLC, although the Entrée/Oyu Tolgoi JV shares usage. As a result of this, Entrée recognizes those capital costs incurred by OTLLC on the Oyu Tolgoi mining licence as an amortization charge for capital costs calculated in accordance with Canadian generally accepted accounting principles. These costs will be determined yearly and are based on the estimated tonnes of concentrate produced for Entrée’s account during that year relative to the estimated total life-of-mine concentrate to be produced (for processing facilities and related infrastructure), or the estimated total life-of-mine tonnes to be milled from the relevant deposit(s) (in the case of underground infrastructure). The charge is made to Entrée’s operating account when the Entrée/Oyu Tolgoi JV mine production is actually milled.

For direct capital cost expenditures on the Entrée/Oyu Tolgoi JV Property, Entrée recognizes its proportionate share of costs at the time of actual expenditure.

A summary of the amortization charges for capital costs incurred by OTLLC on the Oyu Tolgoi mining licence for the 2021 Reserve Case and the 2021 PEA and a summary of the Entrée/Oyu Tolgoi JV capital expenditures, including expansion and sustaining capital for the 2021 Reserve Case and the 2021 PEA are shown below.

Entrée/Oyu Tolgoi JV Property Capital Costs – 2021 Reserve Case and 2021 PEA

| 2021 Reserve Case (HNE Lift 1) |

2021 PEA (HNE Lift 2) |

||||||

| Description | Unit | Entrée/Oyu Tolgoi JV | Entrée 20% Attributable | Entrée/Oyu Tolgoi JV | Entrée 20% Attributable | ||

| Amortization Charges for OTLLC Capital Costs | US$ M | 701.0 | 140.2 | 201.2 | 40.2 | ||

| Mine Development & Sustaining Capital | US$ M | 275.7 | 55.1 | 1,598.6 | 319.7 | ||

Note: Capital costs are inclusive of indirect costs, Mongolian custom duties and VAT and contingency.

The average LOM operating costs for the Entrée/Oyu Tolgoi JV Property (including amortization charges for capital costs incurred by OTLLC on the Oyu Tolgoi mining licence) for the 2021 Reserve Case and the 2021 PEA and mine site cash costs for the 2021 Reserve Case and 2021 PEA are shown below.

| Description | Unit | 2021 Reserve Case (HNE Lift 1) |

2021 PEA (HNE Lift 2) |

| Average LOM cash costs after credits (C1) | US$/lb payable copper | 0.79 | 0.30 |

| Average LOM all-in-sustaining costs after credits (AISC) | US$/lb payable copper | 1.26 | 0.92 |

| Average LOM operating costs | US$/t processed | 46.01 | 28.25 |

Note: The average LOM cash cost, AISC and operating costs for the 2021 Reserve Case includes an amortization charge for OTLLC facility development capital costs. These costs will have been fully recaptured prior to processing material from HNE Lift 2; consequently, no amortization allowance for such development capital costs is payable for the 2021 PEA.

The cash flows in the 2021 Reserve Case and 2021 PEA are based on information provided by OTLLC at the time, including mining schedules and annual capital and operating cost estimates, as well as Entrée’s interpretation of the JVA terms, and certain assumptions regarding taxes and royalties.

The cash flows assume that Entrée will ultimately have the benefit of the standard royalty rate of 5% of sales value, payable by OTLLC under the Oyu Tolgoi Investment Agreement. Unless and until the December 19, 2024 partial final award of the international arbitration Tribunal is fully implemented and Entrée/Oyu Tolgoi JV stakeholders finalize agreements to convert the JVA into a more effective agreement of equivalent economic value, there can be no assurance that the Entrée/Oyu Tolgoi JV will not be subject to additional taxes and royalties, such as the surtax royalty which came into effect in Mongolia on January 1, 2011, which could have an adverse effect on Entrée’s future cash flow and financial condition. In the course of finalizing such agreements or implementing the partial final award, Entrée may have to make certain concessions, including with respect to sharing 34% of Entrée’s economic benefit derived from its interest in the Entrée/Oyu Tolgoi JV Property with the State of Mongolia.

The Entrée/Oyu Tolgoi JV Property (the "Project") is located within the Aimag (province) of Ömnögovi in the South Gobi region of Mongolia, about 570 kilometres south of the capital city of Ulaanbaatar and 80 kilometres north of the border with China.

Road access to the Project follows well-defined roads directly south from Ulaanbaatar requiring approximately 8-12 hours travel time in a four-wheel drive vehicle. OTLLC has constructed a 3.25-kilometre concrete airstrip, partially on the Entrée/Oyu Tolgoi JV Property, which is serviced by charter and scheduled flights to and from Ulaanbaatar. Ulaanbaatar has an international airport, and Tsogt Tsetsii and the Aimag capital of Dalanzadgad have regional airports.

Last Updated: June 2025